Freelancers and micro businesses struggle with managing personal and business finances efficiently. Current tools like QuickBooks and Excel are too complex or lack affordability and personalization. Quicken introduces an affordable way for micro businesses to manage personal and business finances.

However, to improve user adoption and identify areas of improvement, my team set out to conduct user studies and delivered a set of recommendations, starting with asking this question:

Solution

Process & Findings

I began the process with stakeholder interviews and user interviews, where I engaged with five microbusiness owners to uncover barriers to adopting Quicken Simplifi and identify areas for improvement. Building on the insights gathered, I led a competitive analysis to evaluate key criteria such as pricing, advisor availability, and project and tax management features, as highlighted during both stakeholder and user interviews. My team then conducted heuristic evaluations and usability tests to pinpoint features that hindered adoption and complicated transitions from prior applications. Across these research methods, recurring issues emerged, leading us to the following key insights:

- Users struggled with technical language and information overload

- Concern for third-party integrations due to habits and trust

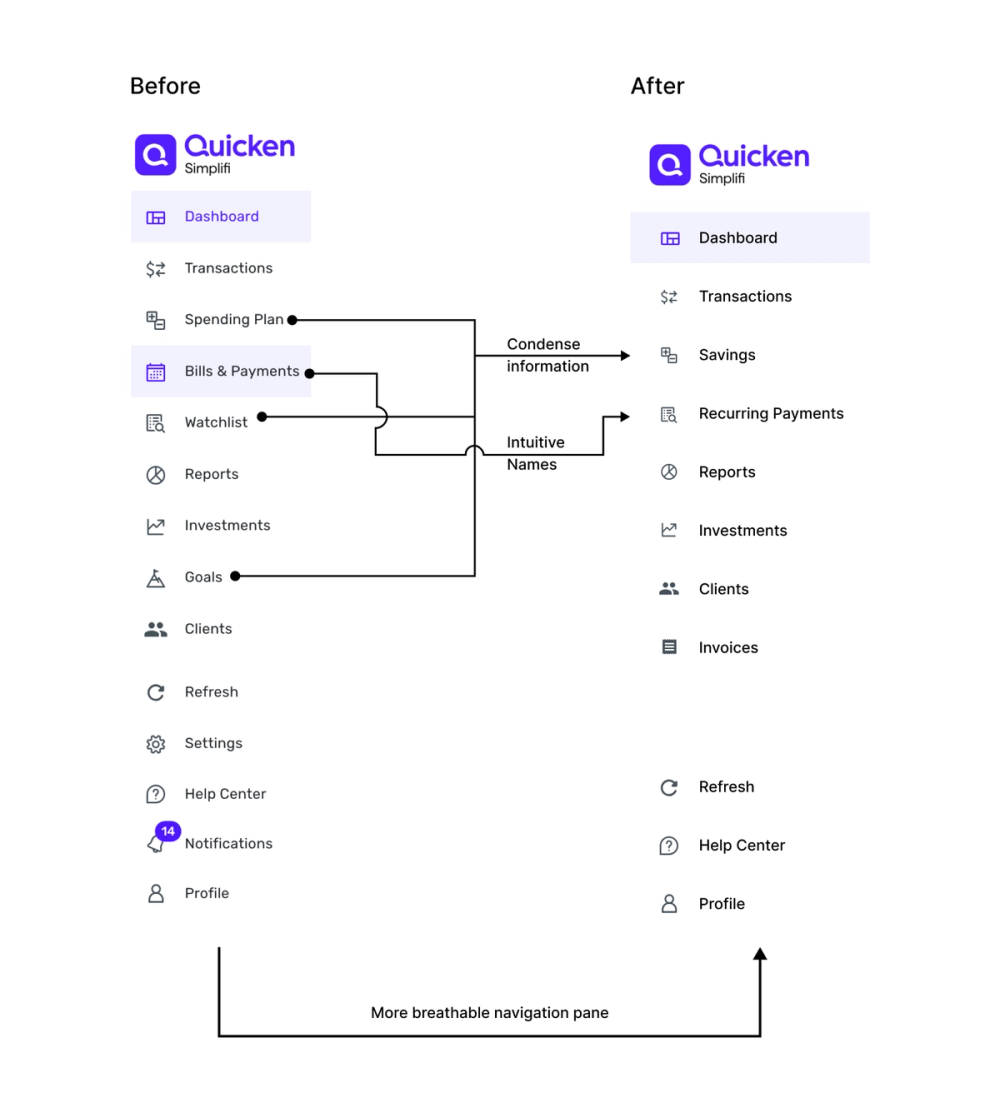

- Navigation was inefficient, with redundant or misplaced features

Design Recommendations

Simplify Language and Layout:

- Use color coding for income/expenses

- Add tooltips for complex features

- Ensure all navigation elements are visible without scrolling

- Incorporate a search bar for easy access

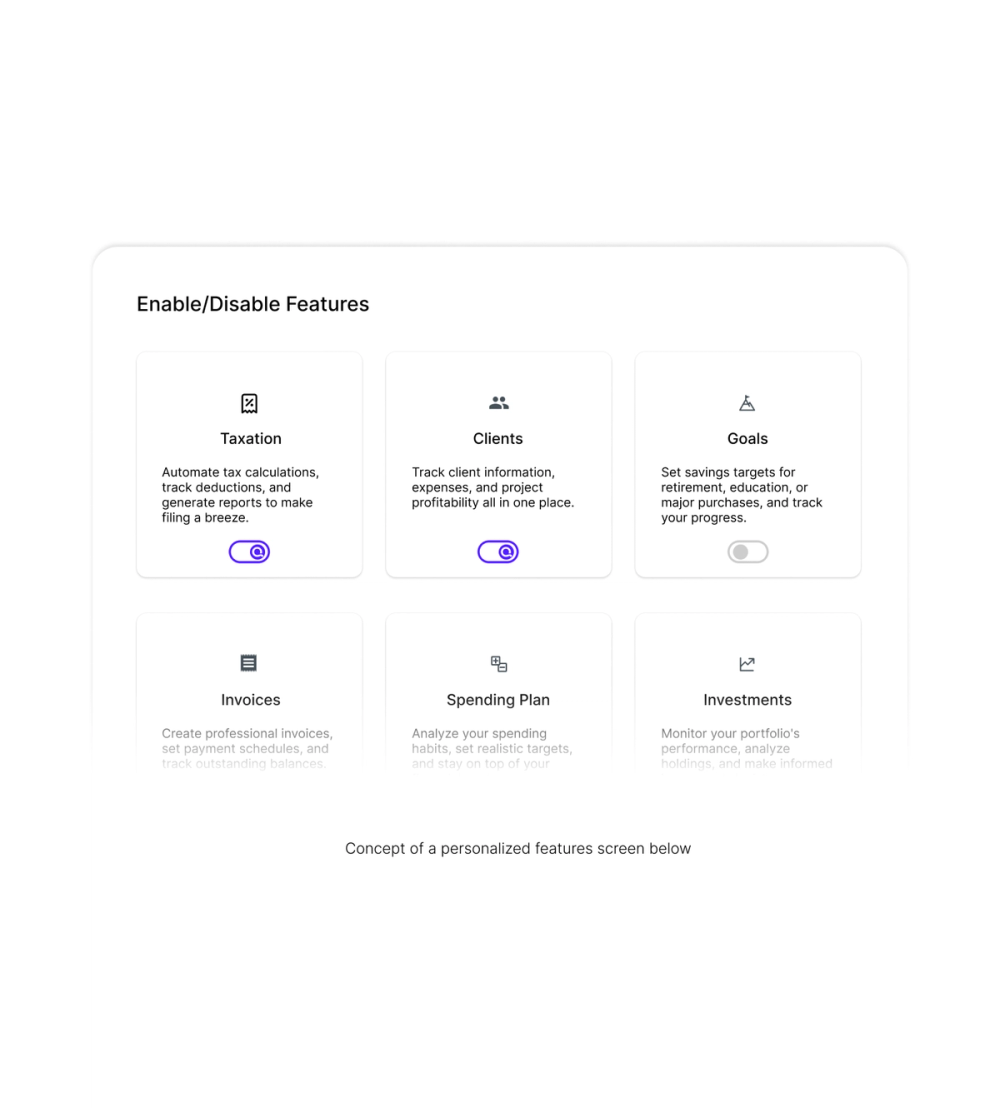

Persona-Driven Features:

- Enable users to customize dashboards based on their preferences, add/remove features based on their workflow

- Highlight high-demand features like taxation during tax season in more accessible locations

Shortcuts for Navigation:

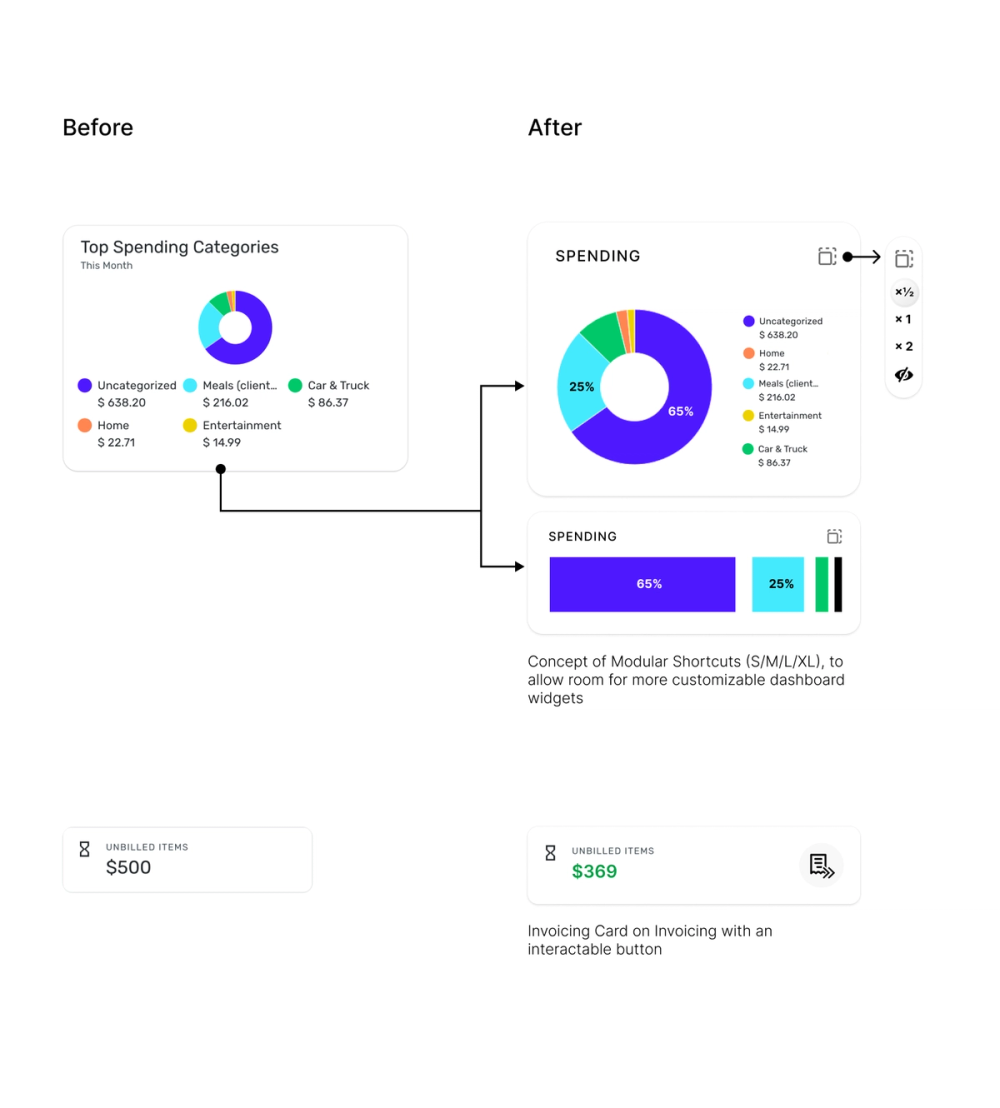

- Introduce modular cards for customizable dashboards

- Allow users to create personalized shortcuts for frequent tasks

Challenges

- Challenge: Usability testing on a beta product limited actionable findings

We conducted various research methods—including usability testing, heuristic analysis, competitive analysis, and affinity mapping of user interviews—to align insights across all stages. By revisiting and cross-referencing research findings at every step, we ensured that our approach remained focused and consistent, enabling us to address key challenges effectively.

- Challenge: Users were resistant to change, preferring in-person interactions for taxes due to trust and familiarity.

We prioritized stakeholder requirements but shared this insight, recommending future strategies to build trust in digital solutions.

Impact

- Proposed Changes: Presented actionable recommendations for improving usability, navigation, and user trust

- Stakeholder Feedback: Positive reception, with plans to implement streamlined dashboards and modular cards

- Outcome: Improved alignment of the app with the needs of freelancers and microbusinesses, enhancing its competitive positioning

Learnings and Takeaways

What Went Well:

- Collaboration within a UX-focused team improved efficiency and insights.

- Gained a deeper understanding of financial management tools and their users' needs.

What Could Be Improved:

- Broader recruitment strategies for interviews.

- Conduct usability tests on stable product versions for actionable feedback.

Possibilities for the Future:

- Explore trust-building features, such as partnerships with accountants.

- Extend findings to other domains within financial tools for similar user segments.